20 Insurance Forms to Help Standardize and Automate Your Workflow

Working in the insurance industry means that you spend every day in a minefield of competitors and… questions. The easier you make it for your clients to get in touch with you and get what they need (be it a cancellation or a claim), the more likely it is that more clients will trust you with their insurance policies. And online forms can help with that.

How?

Read on to find out more about the top 20 insurance form templates you can just grab, customize with our drag & drop form builder, and then publish anywhere you want: on your site, social media channels, or directly via email or WhatsApp messages.

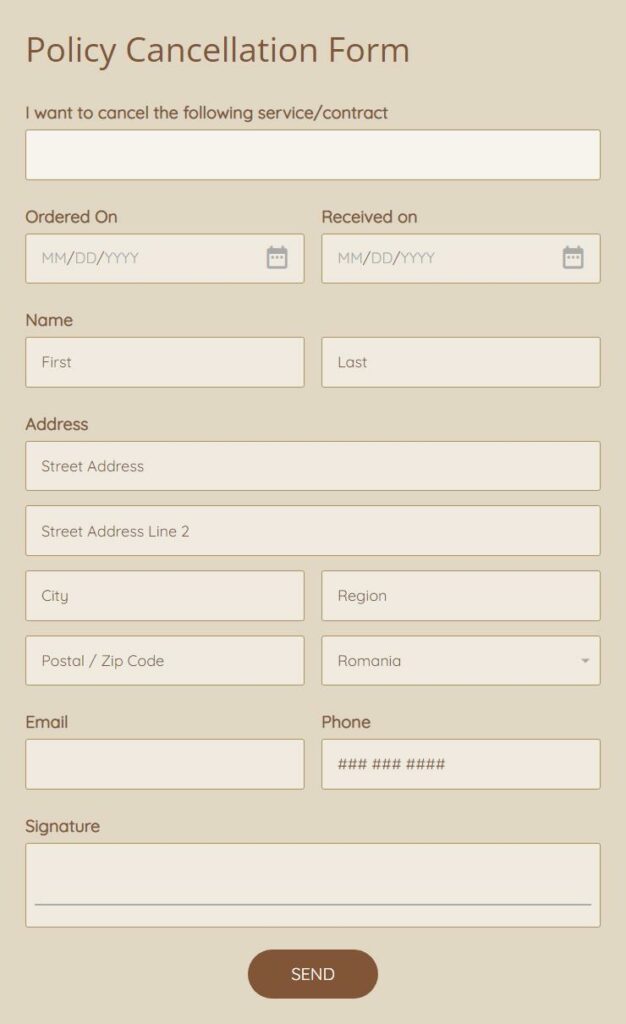

1. Policy Cancellation Form Template

Who needs this?

This policy cancellation form template is meant to be used by insurance companies to make it easy for their clients to cancel a policy. This helps make insurance agents’ lives easier, as well as builds trust with clients who don’t want to be dragged through endless processes just to get their insurance policy canceled.

What’s it for?

The form collects the client’s name, email address, the reason for cancellation, the insurance policy details, and then gives them an option to fill out additional details.

Key benefits

Some of the main benefits of incorporating this form in your processes include quicker turnaround time for policy cancellation requests, as clients don’t need to call your office. Furthermore, clients who use this form will be more likely to trust you with other policies in the future. The form also has a feature that can generate an automated PDF to be sent to the client as soon as the form is submitted. You can also add automated notifications for multiple stakeholders — such as the people in your company who will handle the cancellation, the client, and yourself.

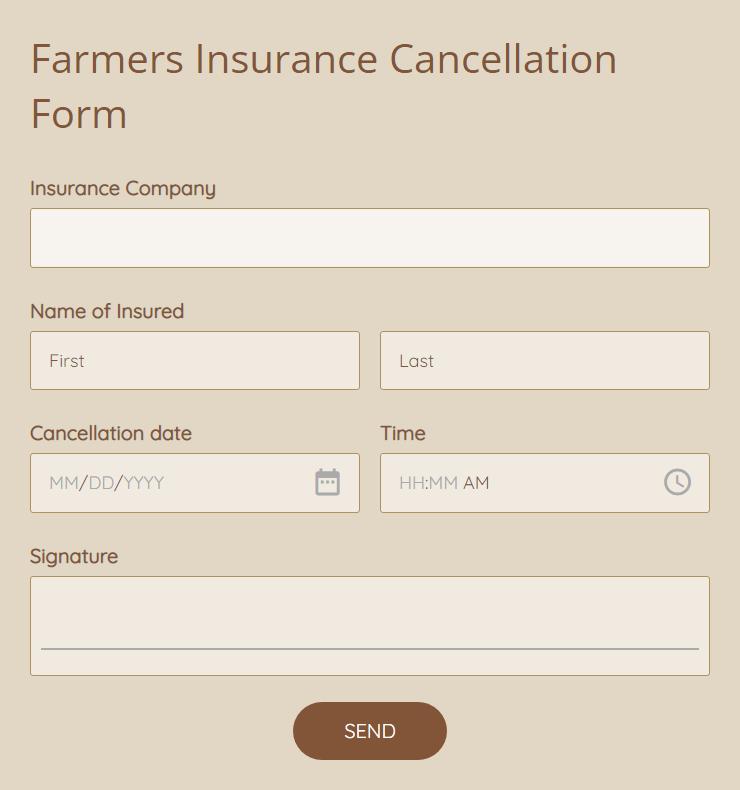

2. Farmers Insurance Cancellation Form Template

Who needs this?

This is what insurers or insurance agents can use to allow their customers to cancel a farmer’s insurance policy.

What’s it for?

The form allows clients to fill out their personal information, as well as the details of their cancellation request, and submit a signature along with their request.

Key benefits

Some of the key benefits of using this farmers insurance cancellation form template include ease of use (you can just get the form, edit it to fit your brand, and publish it anywhere online in minutes), automated email notifications, and the ability to send the client a PDF copy of their policy cancellation request.

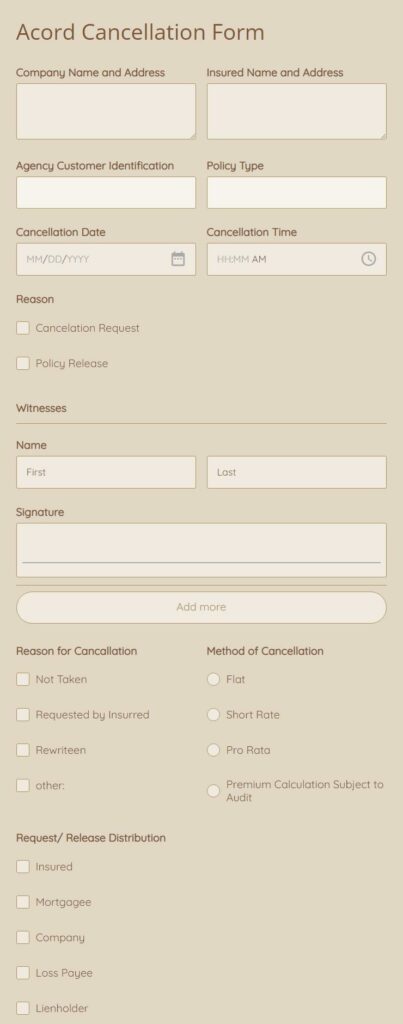

3. Accord Cancellation Form Template

Who needs this?

This cancellation form is meant to be used by insurance companies that wish to make it easy for their clients (who are often business owners) to cancel an accord.

What’s it for?

The form allows clients to fill out their personal information, as well as details of their cancellation request. Furthermore, the form also includes legally binding signature fields that make it easier for both the client and the insurance agency to ensure the smooth flow of the cancellation procedure (even when it happens at a distance).

Key benefits

Some of the main benefits of this form include the ease with which your clients will be able to submit accord cancellation, as well as the ease with which you will be able to collect all data in one place. Even more, our form submission email notification system also enables you to notify all stakeholders (internal and external) upon each submission so your team can jump on the task immediately.

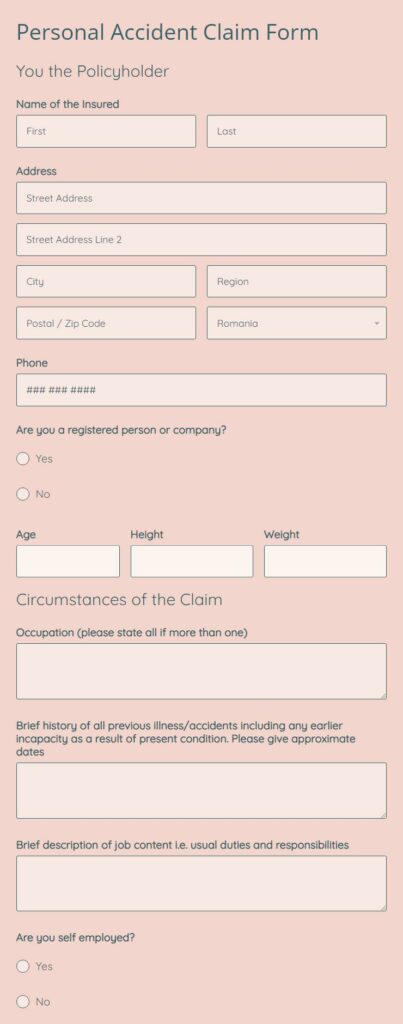

4. Personal Accident Claim Form Template

Who needs this?

This claim form template is meant for insurance companies that wish to make it easy for clients to file a claim following injuries or damage that was caused by a third party.

What’s it for?

The form allows the client to fill out their personal information, as well as details of the incident and how it affected them.

Key benefits

Some of the main benefits of incorporating this form template in your processes include automated email notifications that can be sent to the clients as well as your internal team. Furthermore, the form can also be connected to any tools you use: including Google Sheets, Google Calendar (in case a meeting needs to be set), and so on.

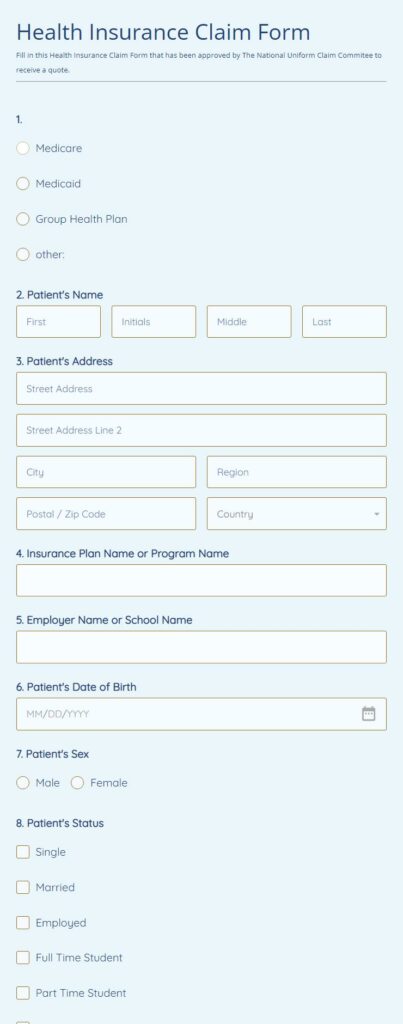

5. Health Insurance Claim Form

Who needs this?

This health insurance claim form template is meant to be used by individuals who need to make a claim for medical expenses.

What’s it for?

The form allows the claimant to fill out their personal information, as well as details of their health insurance claim. The form also includes a legally-binding signature field for the claimant to fill in.

Key benefits

The main benefits of using this health insurance claim form include ease of use (you can just get the form, edit it to fit your needs, and publish it), automated email notifications, and the ability to generate a PDF copy of the form submission automatically.

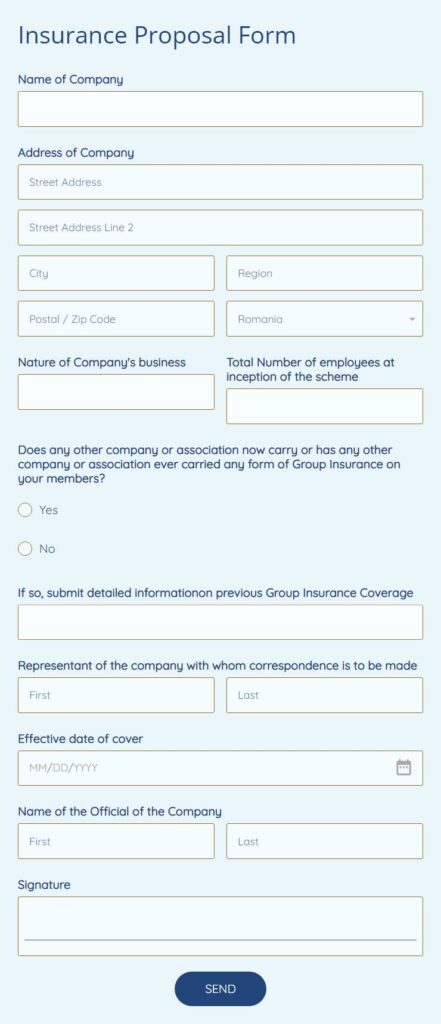

6. Insurance Proposal Form

Who needs this?

This insurance proposal form is meant for insurance agents who wish to make it easy for their clients to submit a proposal for a new insurance policy.

What’s it for?

The form allows the client to fill out their personal information, as well as details of the type of insurance they are looking for, and why. The form also includes signature fields so that both

Key benefits

Some of the main advantages of using this proposal form include ease of use (you can just get the form, edit it to fit your needs, and publish), automated email notifications, and the ability to send a PDF copy of the proposal to the client once they’ve submitted.

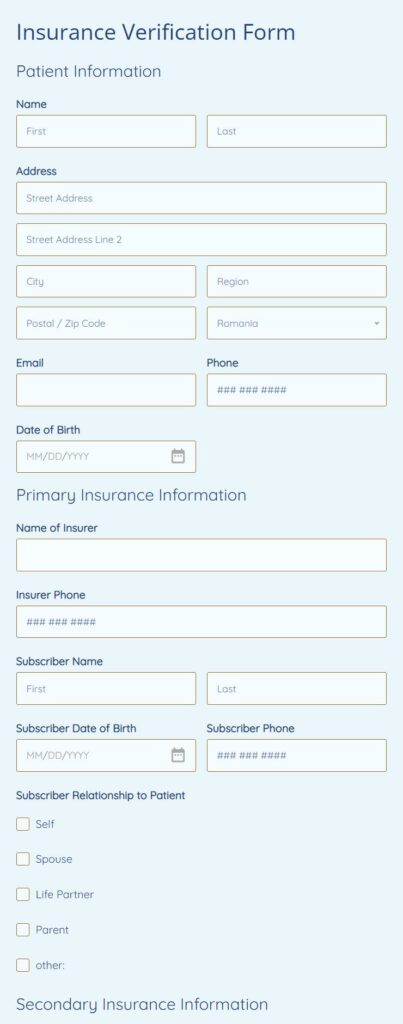

7. Insurance Verification Form

Who needs this?

This insurance verification form is to be used by insurance companies that wish to verify the insurance of a potential client.

What’s it for?

The form allows the company to fill out their personal information, as well as the details of the potential client. The form also includes fields for the agent to input information about the insurance policy and checkboxes for the type of insurance being verified

Key benefits

Setting up this form is very easy and no coding is needed. Furthermore, the form can be set to automatically generate PDFs of the submission to be sent along with an automated email.

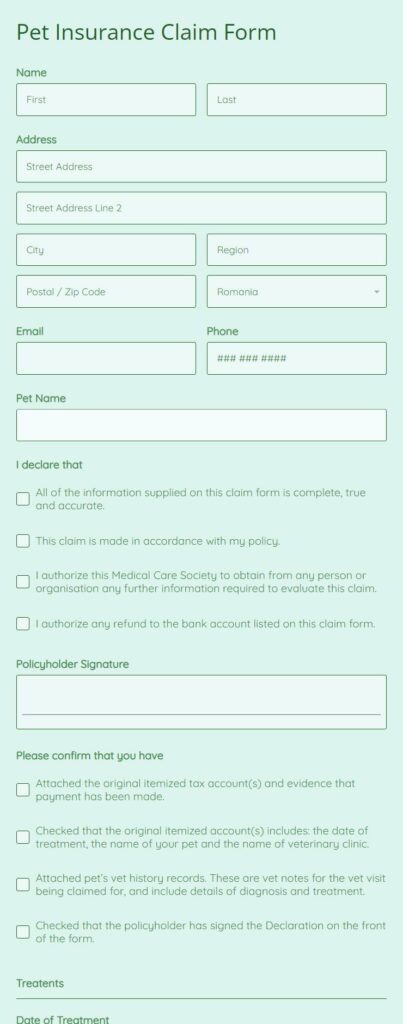

8. Pet Insurance Claim Form

Who needs this?

This pet insurance claim form is to be used by individuals who need to make a claim for veterinary expenses.

What’s it for?

The form allows the claimant to fill out their personal information, as well as details of their pet insurance claim.

Key benefits

Some of the key benefits of using this pet insurance claim form include ease of use (you can just get the form, edit it to fit your needs, and publish it), automated email notifications, and the ability to generate a PDF copy of the form it’s submitted.

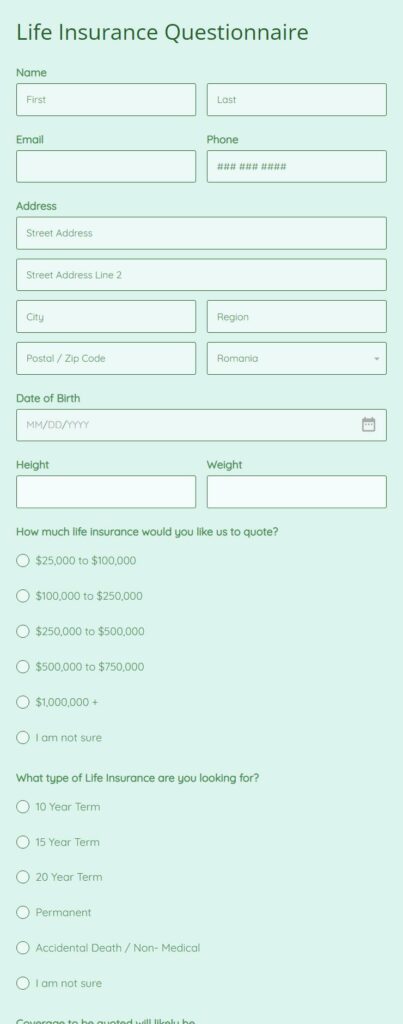

9. Life Insurance Questionnaire

Who needs this?

This life insurance questionnaire is to be used by individuals who are looking for life insurance and want to receive a quote from an insurance company.

What’s it for?

The form allows the individual to fill out their personal information, as well as details of their current life insurance policy and why they are looking for a new one. The form also includes details about the customer looking to buy a life insurance policy, so that the quote is as accurate as possible.

Key benefits

Editing this form template is extremely easy. You can add or remove fields, create conditional logic flows, and even customize the entire form to suit the brand of your life insurance company. ALL without coding!

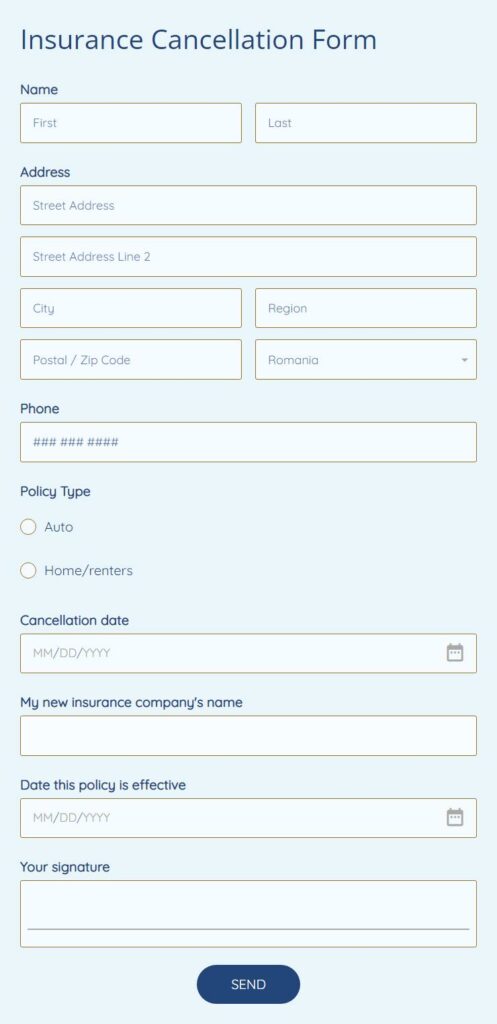

10. Insurance Cancellation Form

Who needs this?

This insurance cancellation form is to be used by individuals who wish to cancel their health, pet, or life insurance policy.

What’s it for?

The form allows the claimant to fill out their personal information, as well as details of their insurance policy and why they are canceling. The form also includes a signature field for the submitter.

Key benefits

Some of the main benefits of using this form include the fact that you can generate automated email notifications and even PDFs of the entire submission just by clicking a couple of buttons. Furthermore, the signature field in the form makes this legally binding and authentic.

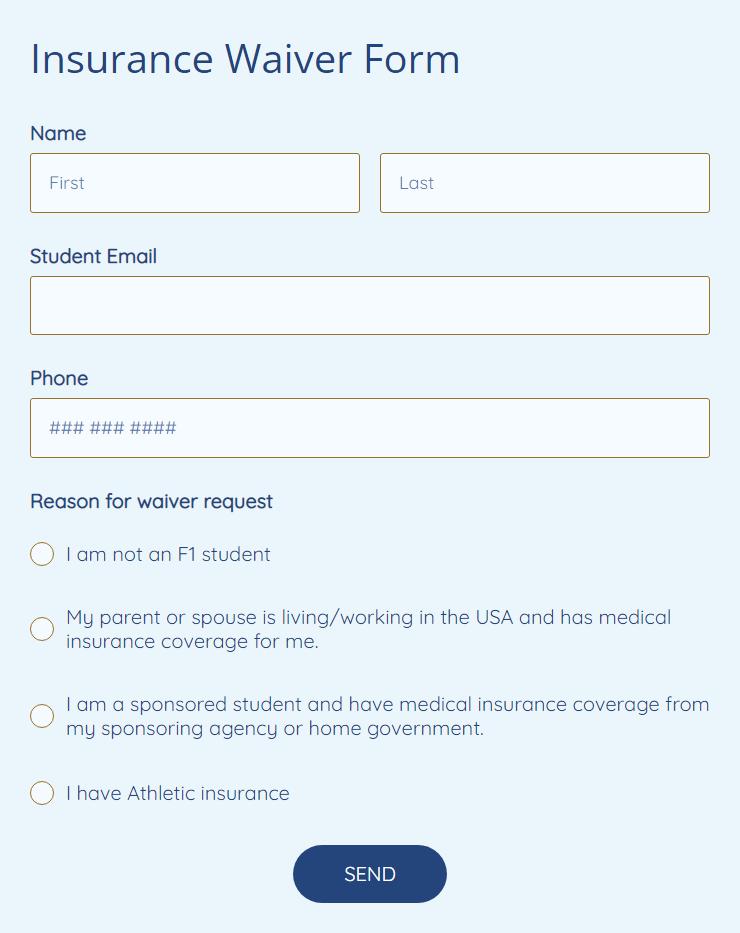

11. Insurance Waiver Form

Who needs this?

This insurance waiver form is to be used by insurance companies to provide their clients with the option to not use the insurance from them in the event of a medical issue.

What’s it for?

The form allows the attendee to fill out their personal information easily. Furthermore, it enables form receivers to stay on top of all the insurance waiver submissions with ease.

Key benefits

This insurance waiver form template will help you smooth out your processes and create an insurance waiving workflow that really WORKS for your insurance company. Setting up the form is as easy as 1-2-3: just get the template, customize it with our drag & drop editor, and publish it anywhere online.

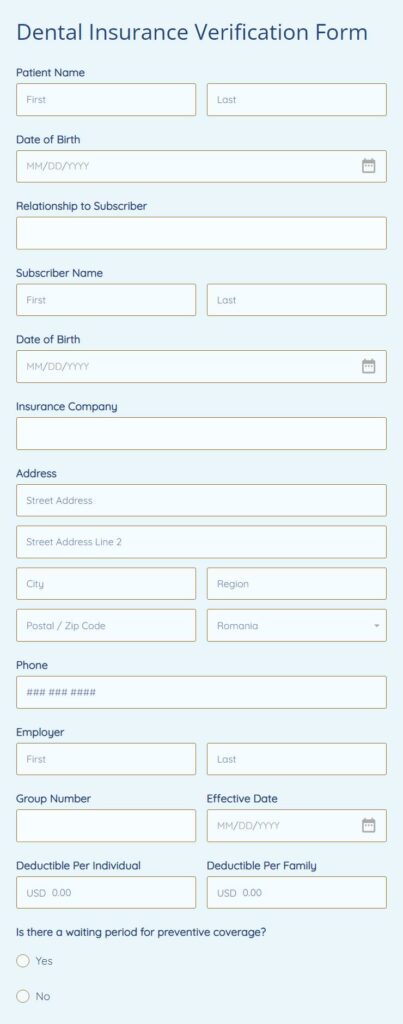

12. Dental Insurance Verification Form

Who needs this?

This dental insurance verification form is to be used by dentists and their staff to verify the dental insurance of their patients.

What’s it for?

The form allows the dentist or their staff member to fill out the personal information of the patient, as well as the name of their dental insurance company and policy number. The form also includes a section for the staff member to sign as verification of the information.

Key benefits

Some key benefits of using this dental insurance verification form template include the ability to easily customize the form to fit your needs, the option to generate PDFs of the submission, and automated email notifications.

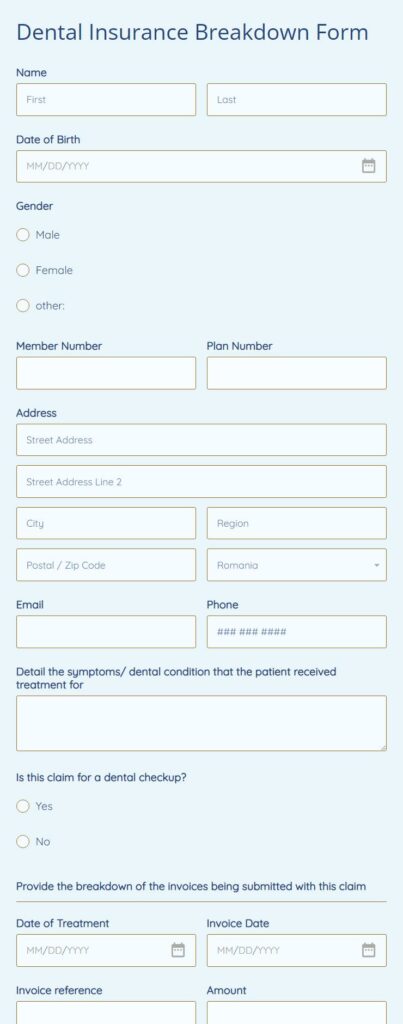

13. Dental Insurance Breakdown Form

Who needs this?

This dental insurance breakdown form is to be used by dentists and their staff to provide patients with a breakdown of their dental insurance costs.

What’s it for?

The form allows the dentist or their staff member to fill out the personal information of the patient, as well as the name of their dental insurance company and policy number. The form also includes a section for the staff member to sign as verification of the information.

Key benefits

Some key benefits of this form include its ease of use (no coding is needed), the option to generate automated emails to be sent to the patient, as well as the option to send them an automated PDF with their submission.

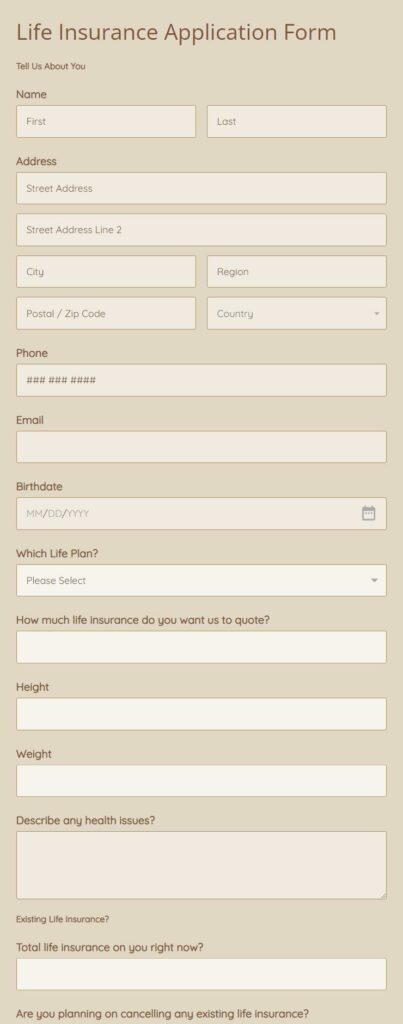

14. Life Insurance Application Form

Who needs this?

This application form is meant for insurance companies that want to provide their future clients with an easy way to apply for life insurance as their service.

What’s it for?

The form allows the claimant to fill out their personal information, as well as details of their life insurance policy and why they are applying. The form also includes a field where clients can add further comments.

Key benefits

Some key benefits of using this form include the ability to easily customize the form to fit your needs, the option to generate PDFs of the submission, and automated email notifications.

Insurance companies can improve their customer service by providing their clients with easy-to-use form templates. These forms make it easy for the customer to provide information, as well as to understand what is required of them. The forms also include signature fields, making them legally binding and authentic.

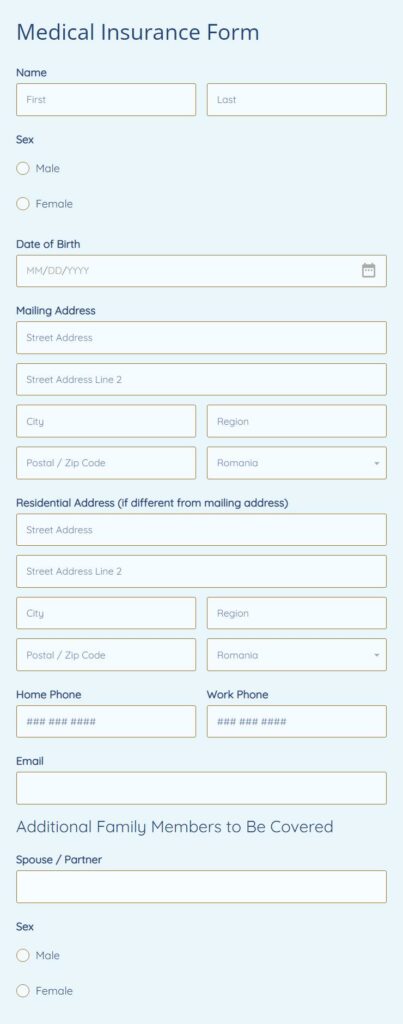

15. Medical Insurance Form

Who needs this?

This medical insurance form is to be used by insurance companies when they want to collect information about people interested in purchasing a medical insurance policy from them.

What’s it for?

The form allows the client to fill in all the basic info needed to receive an accurate medical insurance quote and clear information from the insurance agent.

Key benefits

The main benefit of using this medical insurance form is the ease of use. Setting it up will take minutes and will require zero coding on your end. Furthermore, filling in the form will be extremely easy for your clients as well.

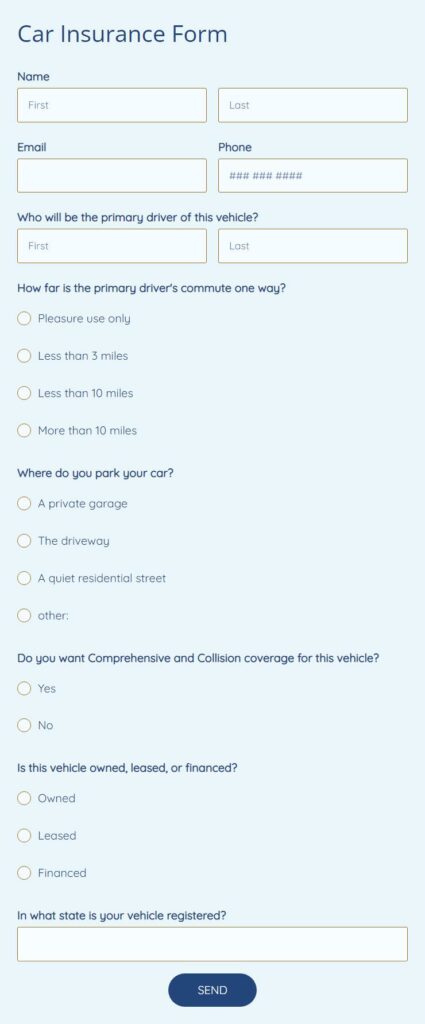

16. Car Insurance Form

Who needs this?

This car insurance form is to be used by insurance companies providing car insurance services when they want to collect information about people interested in purchasing a car insurance policy from them.

What’s it for?

The form allows the client to fill in all the info the agent will need to create an accurate estimate of what car insurance would be a better fit for the client.

Key benefits

Just like our other form templates, the key benefit of using this form is the ease of use (both on your end as an insurance agent and on your clients’ end). Furthermore, you can set up this form to generate automated quotes as well, thus making the client acquiring process easier.

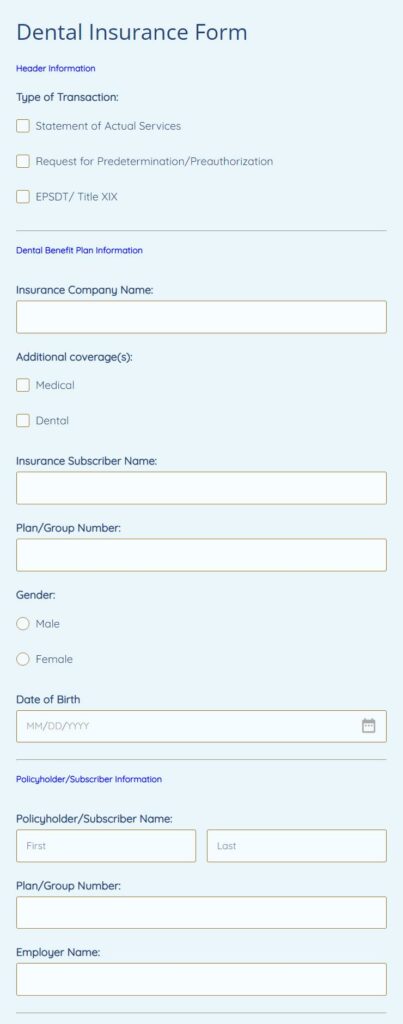

17. Dental Insurance Form

Who needs this?

This dental insurance form is to be used by dental practices when they need to collect information about a patient’s dental insurance.

What’s it for?

The form allows the dental practice to fill in all the info they’ll need about a patient’s dental insurance, in order to provide them with an accurate estimate for their services.

Key benefits

Just like our other form templates, key benefits of using this dental insurance form include ease of use and the option to generate automated email notifications (including emails that have a PDF of the form submission attached to them).

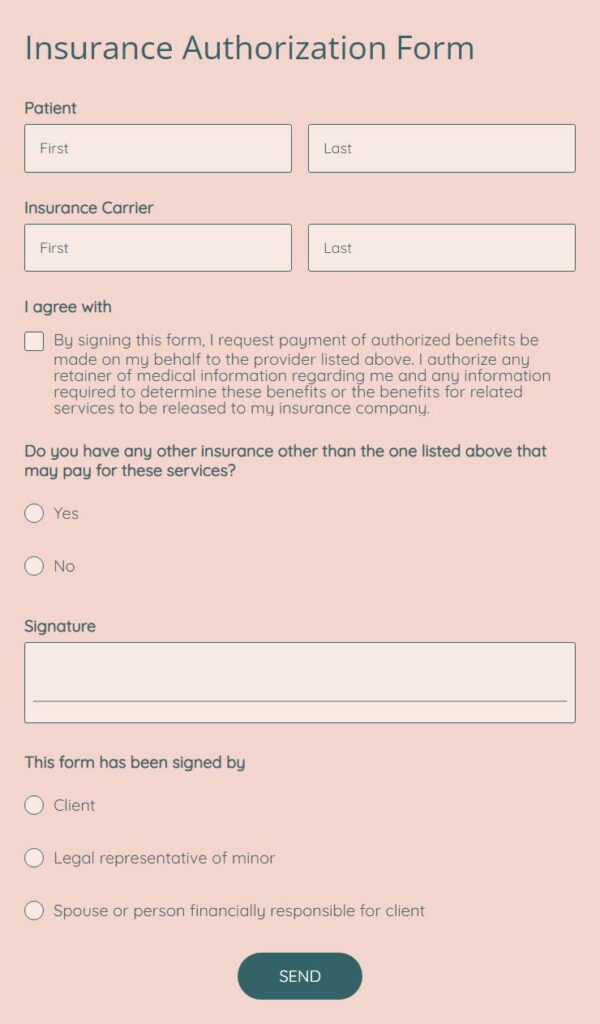

18. Insurance Authorization Form

Who needs this?

This insurance authorization form is meant for individuals who need to authorize their insurance company to speak with a doctor or medical professional on their behalf.

What’s it for?

The form allows the individual to fill out all the info needed by the medical or repair service providers to accept the insurance policy of the patient/ customer as payment (or partial payment) for their services.

Key benefits

Some key benefits of using this form are that the form is pre-made to collect all the relevant info, it’s easily customizable to fit your specific needs, and you have the option to generate PDFs of the submission.

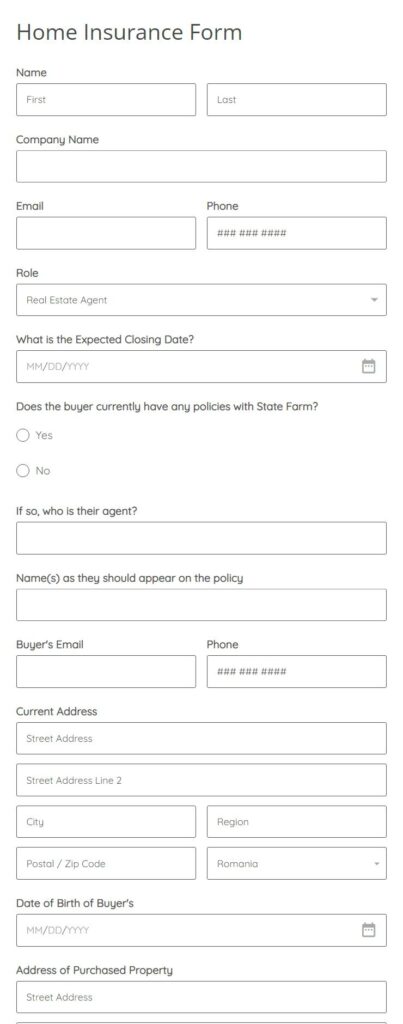

19. Home Insurance Form

Who needs this?

This home insurance form is to be used by real estate brokers, lenders, real estate attorneys, insurance brokers, and so on — basically, anyone who needs to collect information about a home insurance policy.

What’s it for?

The form allows the user to collect all the info they need about the home insurance policy, such as the name of the insurer, the dates of coverage, and the amount of coverage, as well as the closing date and any other information the insurance company should be aware of.

Key benefits

Setting up this form is very easy (it only takes a few minutes) and it’s extremely user-friendly. If you want to edit anything in it (including adding or removing fields), all you have to do is drag & drop (no coding is needed). Plus, you have the option to generate PDFs of the form submission.

20. Online General Insurance Quote Form

Who needs this?

This online general insurance quote form is for individuals or businesses who need to obtain a quote for general insurance.

What’s it for?

The form allows the user to provide all the necessary info about their needs so that they can get an accurate quote for general insurance from the provider.

Key benefits

Some key benefits of using this online general insurance quote form template include ease of use, the ability to create automated quotes, security, and the ability to send automated email notifications with PDF attachments.

Insurance Form Templates – Frequently Asked Questions

Which entity approves the insurance policy forms used in Florida?

The state’s Office of Insurance Regulation has the authority to approve insurance forms in Florida.

What are the recommendations for completing insurance forms to facilitate optical scanning?

Electronic business practices for optical scanning recommend using a font size of at least 10 pt and limiting the number of different fonts to two or less (one serif and one sans-serif). Furthermore, proper spacing and contrast between the text and background should be maintained; light colors on non-white backgrounds are not recommended because they may become unreadable when scanned.

What is the most common method to submit insurance forms?

The most common method of submitting insurance forms is via email attachment. However, many businesses are now allowing customers to submit their confidential information through web-based forms that use encryption technology for security purposes. This is why online forms come in easier: the data submitted through an online form is 100% encrypted and secure, so they enable insurance companies to collect personal details from clients via online means as well.

When do you get medical insurance forms?

Most insurance companies will send their clients medical claim forms in the mail once they have requested them. This is why it is recommended that medical insurance agents provide their clients with a selection of digital forms that can be filled out, signed digitally, and then used for submission.

What benefit does electronically processing claim forms to insurance carriers have?

Electronic processing of claim forms has several benefits for both insurance companies and their clients. The primary reason for this is that it enables the client’s personal information to be transferred more securely, with complaints being sent directly to the carrier. Furthermore, electronic claim forms reduce turnaround times between submission and processing. They also make it easier to administer the entire claims process.

Load more...